Media and telecoms insights: quick action required as broadcast and streaming revenues converge

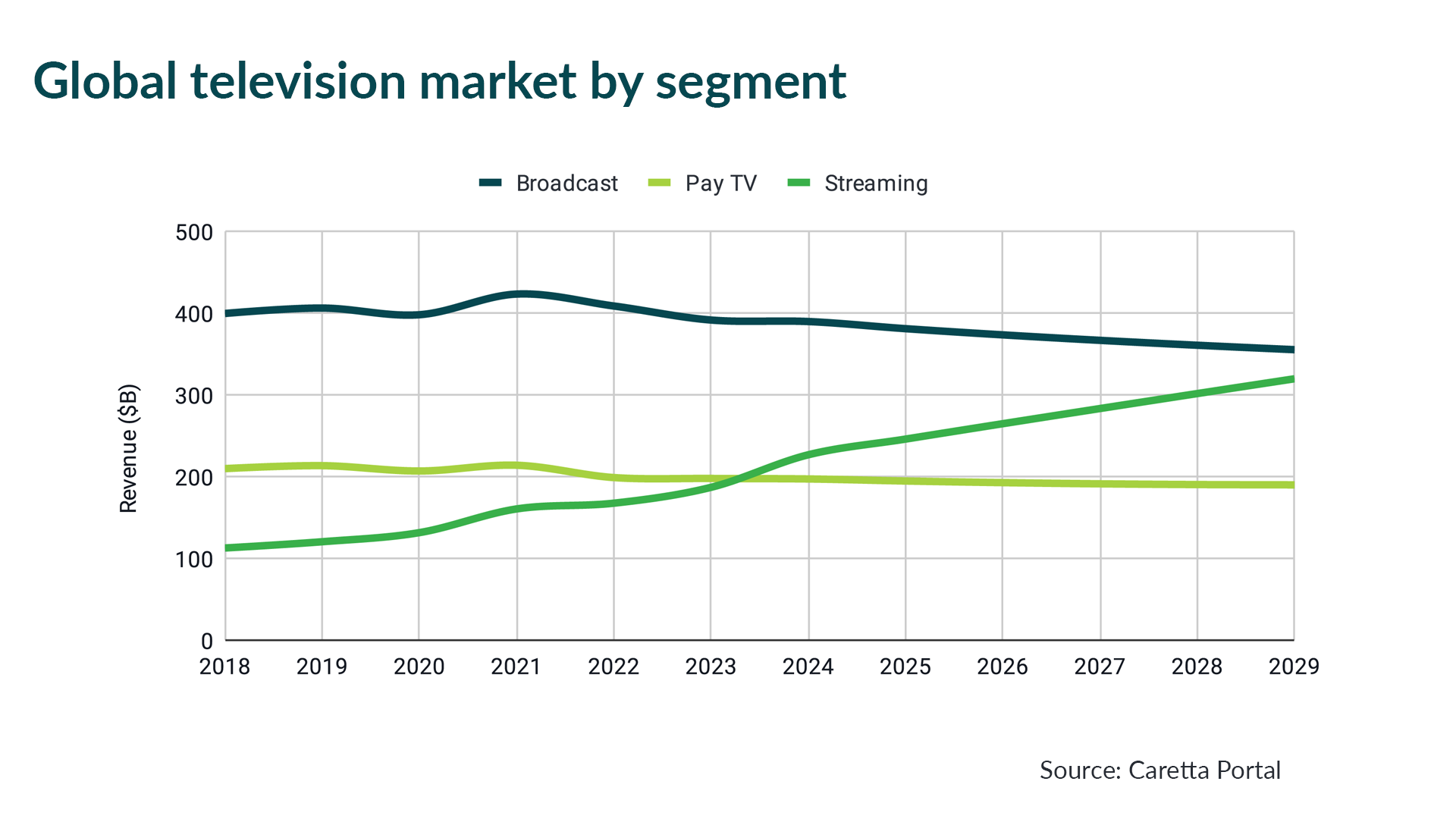

New global data from Caretta Research highlights a stark reality for the broadcasting industry: broadcast and pay TV are expected to lose $42B in revenue, while streaming is expected to grow by $93B (41%) by the end of the decade. Streaming is set to take a significant share of revenue from traditional broadcast and pay TV from 2024 to 2029.

The looming broadband crossover

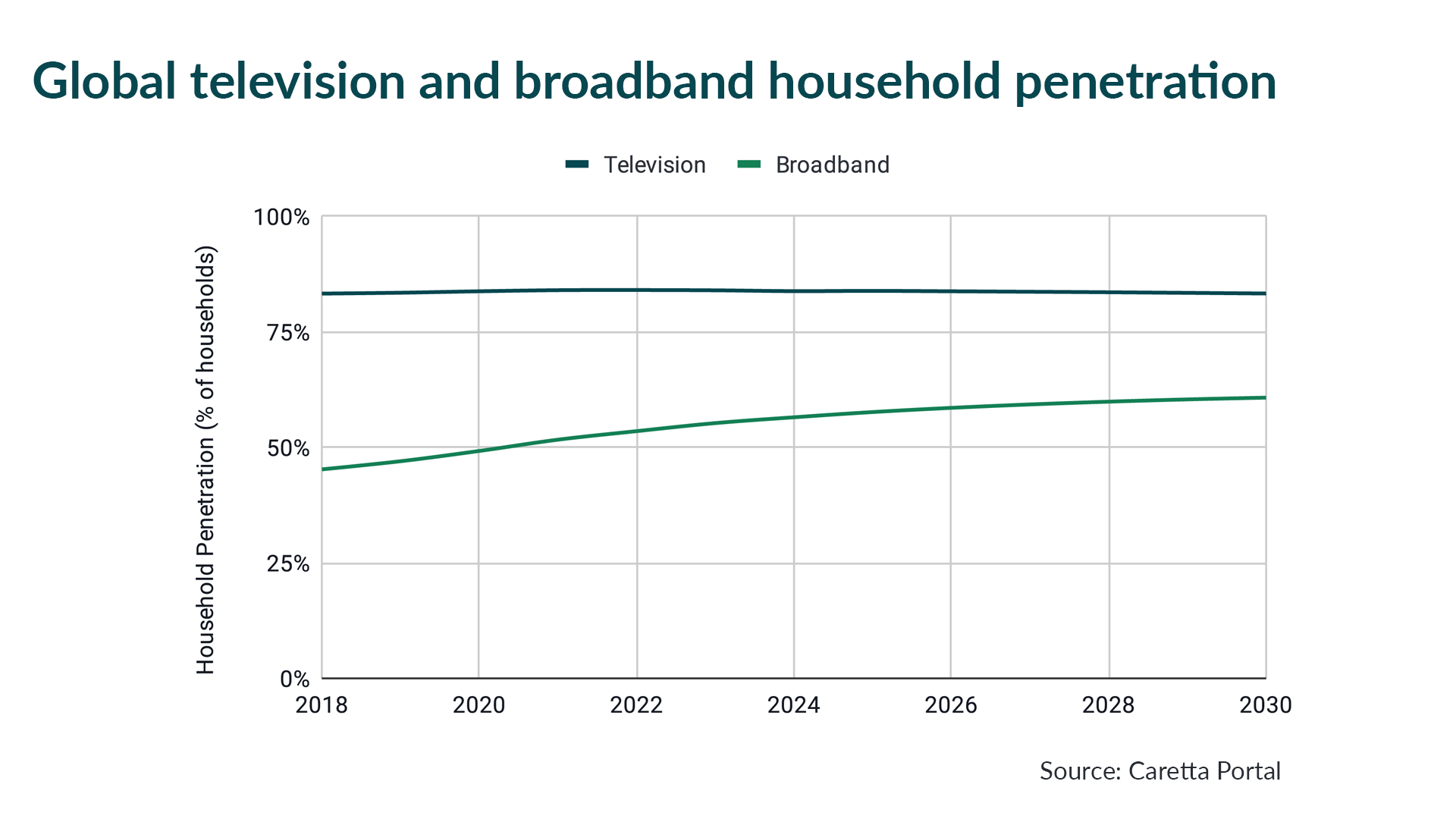

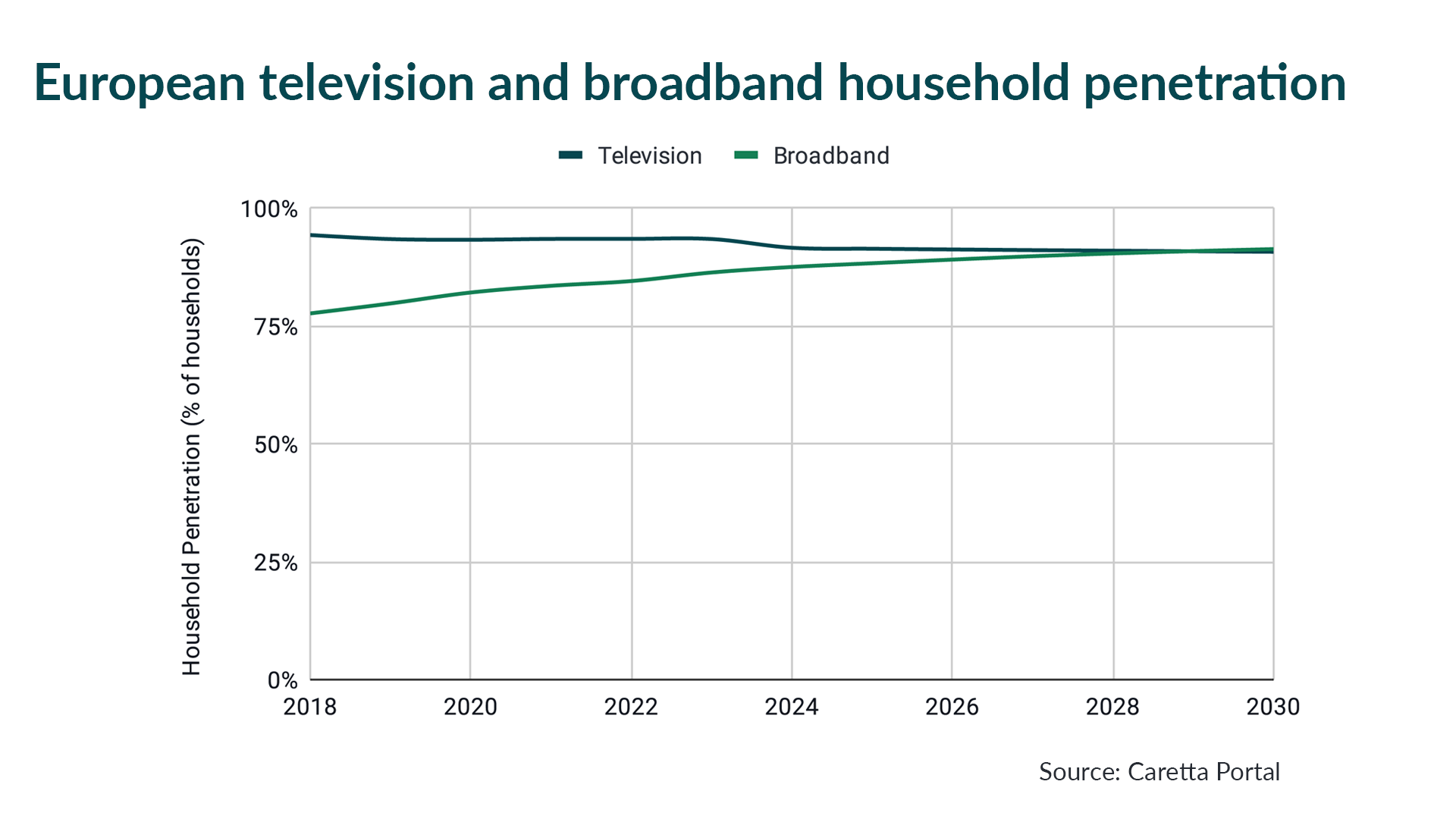

Traditional TV household penetration is in decline and broadband penetration is increasing, signalling an urgent need for broadcasters to accelerate their streaming strategies.

The situation is most acute in Europe where TV set ownership is declining. The number of households with broadband access will surpass those with a TV set by 2030, enabling Wi-Fi-connected smartphones and tablets to challenge the TV set as the key devices for reaching mass audiences.

Unlocking global insights with Caretta Portal

Understanding the unique nuances of each market is paramount. That’s why our latest media and telecoms services insights are now available in Caretta Portal. This comprehensive resource empowers media professionals to understand the pace of the streaming transition in over 200 countries. Users can access company-by-company market sizing data for broadcast, pay TV, streaming, and telecoms, enabling them to develop highly detailed and effective strategies tailored to the markets they operate in.

Industry stakeholders can also access those insights through a comprehensive country-level page for rapid analysis of key strategic insights for each country:

- How television audiences and revenues are split across streaming, satellite, cable, IPTV and DTT

- The status of TV set ownership and broadband access

- Which television services have invested in which sports rights

- Macro economic trends such as GDP, population, number of households and average household size

This critical data empowers media organisations to identify opportunities and ensure their content reaches audiences through the most relevant and growing channels.

A call to action for broadcasters

Broadcast and streaming are both huge opportunities in the next five years and successful strategies need to address both audiences. Recent content sharing and cross-promotion deals between ITV and Disney, and TF1 and Netflix, show how broadcasters and streamers are starting to think outside their own apps to achieve this. These deals also put further pressure on pay TV operators’ role as content aggregators.

The opportunity for technology vendors

For technology vendors the opportunity has moved past streaming enablement. To thrive, they must provide efficient solutions that help media companies manage the operational, technical and contractual complexity arising from distributing content across an increasingly wide array of partners, platforms and deals to maximise audiences.

The convergence of broadcast and streaming revenues demands quick action. The time to adapt and thrive in this rapidly changing media ecosystem is now. To learn more about media and telecoms services insights, contact info@carettaresearch.com.