Redefining the agency model: the future of advertising holding agencies in an AI-driven world

The advertising industry is changing at a breakneck pace. While its overall global growth far outpaces global GDP growth, many traditional advertising incumbents are struggling to keep pace. This underperformance signals a deeper crisis within the agency model, exacerbated by technological advancements, particularly in AI. While agencies are aware of the threat, their reaction has been notably sluggish.

Ad market growth is bypassing traditional agencies

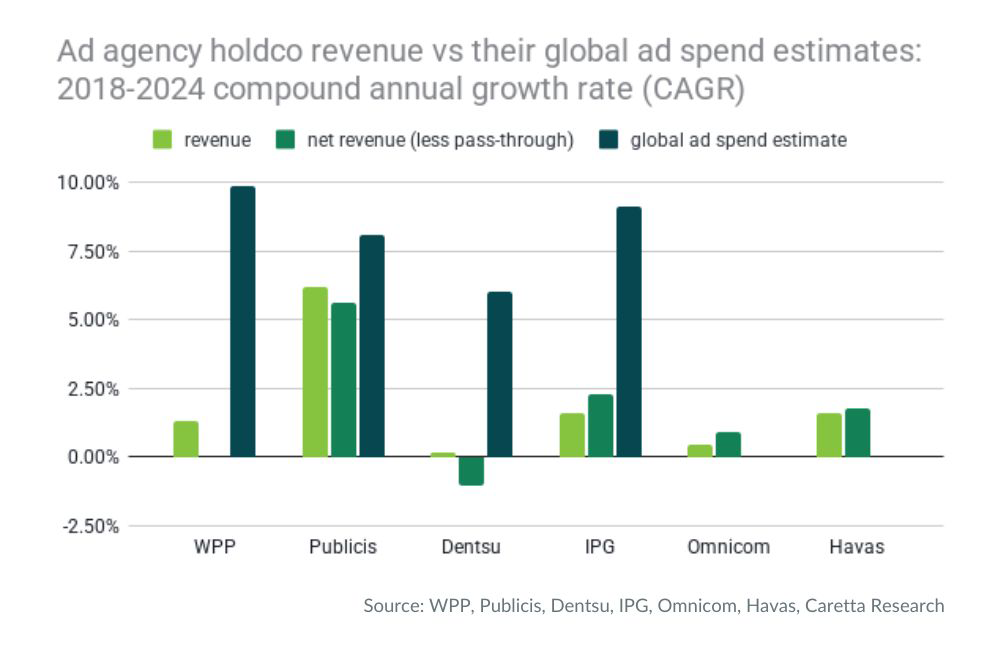

A clear indicator of this struggle is the disparity between global ad market growth rates and the growth of advertising holding companies. For the past six years, the four major holdcos that publish global ad market projections (WPP, Publicis, Dentsu, and IPG) have consistently estimated total ad spend growth rates that significantly exceed their own revenue growth (see chart). This suggests that a substantial portion of the market’s expansion is happening outside the purview of traditional agencies.

The reality is likely even more dire than these figures suggest. Agencies, by the nature of the data they aggregate from their subsidiaries, tend to underestimate the spend originating from the long tail of small and medium-sized businesses (SMBs).

Yet, it is this market segment – unaddressable and virtually invisible to agencies – that propelled the growth of big tech walled gardens like Google and Meta (which achieved compound annual growth rates (CAGR) of 17% and 19.5% respectively between 2018-2024). Emerging players like Amazon and TikTok have also leveraged this segment as the launchpad for their ad businesses.

Adding to these signs of trouble is the slower growth of net revenue, although this trend is not universal across all agency holding companies. Net revenue, or revenue less pass-through costs, reflects only the agency’s fees for services rendered. Gross revenue encompasses all money that passes through an agency’s books, including media spend.

The slower growth of net versus gross revenue indicates that agencies are becoming less involved in the actual media buying and placement, effectively becoming consultants rather than primary drivers of ad spend. This trend highlights their diminishing control over the overall advertising budget, further eroding their traditional role.

However, to be fair, this metric is subject to differences in accounting practices and is also affected by the relative size of the public relations, creative, media buying, and data and technology components of the holding company’s business.

AI, automation and first-party data drive in-housing

The rise of new technologies has empowered brands to bring functions in-house that were traditionally performed by agencies, leading to a significant shift in the industry landscape.

On the creative side of advertising, the advent of generative AI has brought a severe and sudden disruption. AI-powered tools can now generate high-quality ad copy, visual assets, and even entire campaigns with unprecedented speed and efficiency. These capabilities will tempt many brands to internalise the day-to-day execution of creative tasks, achievable by lean teams empowered by AI tools.

Programmatic advertising and algorithmic trading, on the other hand, have been a disruptive force in media buying for a longer period. For years, agencies have seen their role in the execution of digital media buys diminish as automated and increasingly user-friendly platforms empowered brands to take media buying in-house or split this competency with smaller, more specialist agencies, as evidenced by the demise of centralised agency trading desks.

The growing importance of first-party data, against the backdrop of slow cookie deprecation, has created further incentives for brands to build internal capabilities in data handling and its use for media buying.

However, what is new and particularly concerning for agencies now is that this algorithmic disruption is rapidly coming for TV ad spend. As television viewing transitions to connected TV (CTV) platforms and streaming services, the ability to buy and optimise TV inventory programmatically is becoming a reality. This shift threatens to disintermediate agencies from a significant portion of traditional media spend, further eroding their revenue streams and control over media budgets.moditizing their precious data. Building their own infrastructure, on the other hand, requires substantial investment.

Agencies need to revamp their value proposition from execution to strategic guidance and data-centric services

While the current challenges are formidable, the predicament of disintermediation in the advertising industry is nothing new. Historically, as technology evolves and becomes more complex, there is often a temporary period where specialised expertise in applying that technology becomes paramount. This renewed need for expert guidance can, in turn, create new opportunities for agencies.

Creative agencies will need to move fast to reposition themselves as partners and advisors providing strategic creative direction to in-house creative teams, winding down their own large-scale creative execution teams in the process.

Development and acquisition of AI creative tools and repositioning as a technology provider is another potential pathway available to creative agencies, though this is a far bigger strategic pivot and will result in agencies competing with big tech on their home turf. The speed of innovation in the generative AI space will ensure that the transition is chaotic, particularly for large organisations.

In media buying, the increasing fragmentation on the media owner side presents a unique challenge for brands. While they have been navigating such fragmentation in the digital space for a considerable time, it is now rapidly enveloping TV advertising. With a growing number of platforms, channels, and publishers, navigating the media landscape and ensuring effective reach and frequency across diverse audiences is becoming incredibly complex.

As a result, brands will increasingly need an aggregator—a centralised entity that can simplify this complexity, provide a holistic view of media performance and efficiently manage campaigns across multiple platforms. The crucial question, however, is whether traditional agencies will successfully take on this aggregator role or if it will be assumed by technology platforms, perhaps even by splitting the expertise with in-house teams at brands.

Some agencies are already taking proactive steps to embrace this technological shift and redefine their value proposition. Publicis Groupe has made a significant leap in this direction, and their financial performance reflects this strategic pivot. Their technology division, which primarily consists of Epsilon and Publicis Sapient, achieved nearly 35% organic growth between 2019 and 2024.

This robust growth demonstrates the potential for agencies to thrive by investing in and integrating technology-driven solutions, offering expertise in areas like data analytics, customer experience, and digital transformation, which are increasingly critical for brands. Epsilon’s acquisition of retail media platform specialist CitrusAd, in particular, gives the holdco a strong foothold in the fastest-growing ad market sector.

WPP’s recent acquisition of InfoSum and its integration into the rebranded and relaunched WPP Media (heir to Group M) signals a similar strategic shift. By incorporating advanced data collaboration technology, WPP aims to evolve beyond the role of a traditional media buyer, helping brands navigate the complexities of first-party data utilisation and offering sophisticated solutions for media activation.

Don’t write off the “Mad Men” yet

While agencies are undoubtedly in a period of significant turbulence, their future is not predetermined. Agencies can evolve beyond their traditional media buying and creative execution roles by embracing new technologies, rethinking the composition of their holding portfolios and specialising in complex areas that require expert knowledge. They can provide counsel, services, or even tools that enable lean in-house teams to run effective data-driven campaigns in an increasingly fragmented digital ecosystem. They must overcome their corporate inertia and make the necessary strategic changes before their disintermediation truly snowballs.

For more insights, contact Caretta Research at info@carettaresearch.com.